BOIR Filing: A Complete Guide for 2024

Learn the BOIR Filing Process for 2024. This guide covers how to file a BOIR report, BOIR filing requirements, deadlines, costs, and steps for LLCs and corporations.

PENALTY NOTICE : Failure to file before the federal deadline can result in penalties of $592 per day.

Our BOIR E-Filing System supports the electronic filing of the Beneficial Ownership Information Report (BOIR) under the Corporate Transparency Act (CTA).

Our BOIR E-Filing System supports the electronic filing of the Beneficial Ownership Information Report (BOIR) under the Corporate Transparency Act (CTA). The CTA requires certain types of U.S. and foreign entities to report beneficial ownership information to the Financial Crimes Enforcement Network (FinCEN), a bureau of the U.S. Department of the Treasury.

BOIRegistration.com makes it easy for businesses to file their Beneficial Ownership Information Report. BOIRegistration is not affiliated with the U.S. Government or the Financial Crimes Enforcement Network (FinCEN).

Filing Process

BOI reports are mandatory for most businesses in the U.S., requiring the disclosure of key information about those who own or control a company. Compliance with FinCEN's regulations helps prevent money laundering and ensures transparency.

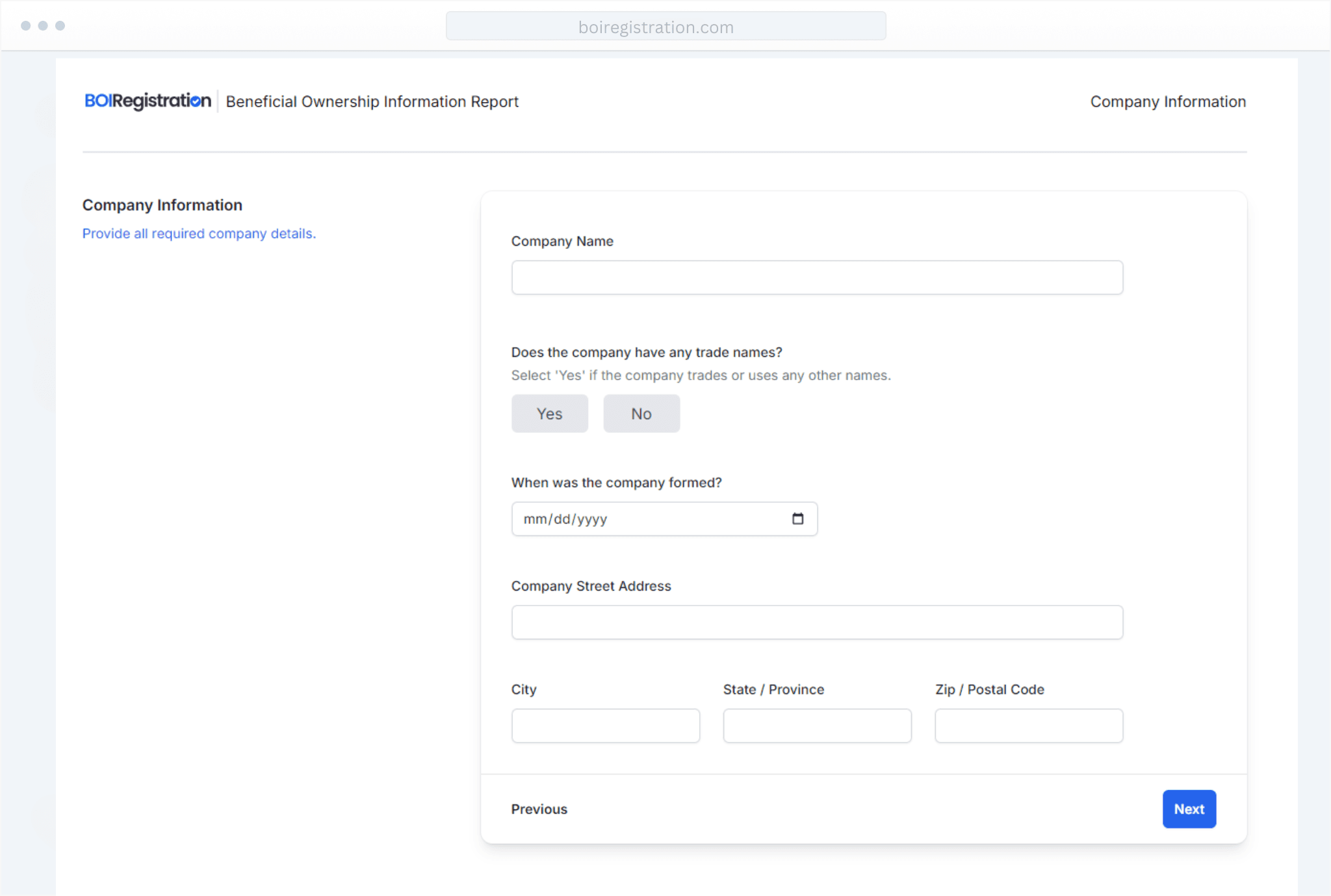

Our platform guides you through the entire process of filing Beneficial Ownership Information (BOI) reports, ensuring compliance with the latest FinCEN regulations. Whether you are an established business or just starting, we help you meet all necessary deadlines.

Whether you're a small business or a large corporation, navigating the BOI filing process can be complex. Let us simplify the process and ensure you stay compliant with all relevant laws and deadlines.

Our platform offers automated alerts and reminders to help you avoid late submissions. No need to stress about the paperwork – we handle everything so you can focus on your business.

We guide you through gathering the necessary details about your company and its beneficial owners, ensuring compliance with federal regulations.

Answer a few simple questions to provide the essential information needed for your BOIR filing. We streamline the process for accuracy and ease.

Once the information is gathered and verified, we handle the submission of your BOIR to ensure timely and accurate compliance with regulations.

Access our guidance documents to stay informed on regulatory requirements, filing processes, and compliance tips for maintaining your business's transparency and legal standing.

View all Guidance documents

Learn the BOIR Filing Process for 2024. This guide covers how to file a BOIR report, BOIR filing requirements, deadlines, costs, and steps for LLCs and corporations.

Discover the fines and penalties for non-compliance with Beneficial Ownership Information (BOI) reporting under the Corporate Transparency Act (CTA).

Learn the key deadlines for filing Beneficial Ownership Information (BOI) reports under the Corporate Transparency Act (CTA). Understand the reporting timelines for companies formed before and after 2024, along with ongoing update requirements to stay compliant with FinCEN regulations.

Discover the 23 exemptions from BOI reporting under the Corporate Transparency Act (CTA). Learn which businesses qualify for exemptions and how to ensure compliance with FinCEN regulations.

An in-depth guide to understanding beneficial owners, their legal importance, and the BOIR filing requirements for 2024 under the Corporate Transparency Act.

Learn about the Corporate Transparency Act (CTA), its purpose, requirements, and implications for businesses in 2024.

The Corporate Transparency Act outlines 23 exemptions from the requirement to report beneficial ownership information. Explore the list below to see if your business qualifies.

If you can’t find what you’re looking for, reach out to our support team at:

support@boiregistration.com and one of our representatives will get back to you as soon as possible.